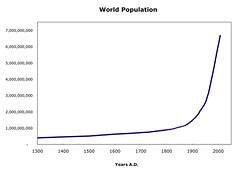

An enterprise starts with the hope of a return on its investment. For a start-up, this is often envisioned on a spreadsheet, with the initial revenues being smaller than the initial expenses creating losses; however, the revenues increasing by some percentage and over time they outpace expenses to generate an attractive return on investment (ROI). While that is the typical story on paper; it's not reflected in the reality around us.

The World Population graph seems to show a linear growth like the one described in the above plan with some event happening in the late 1800's to suddenly make it change. Any idea what that historic event might have been?

If you haven't read the paper folding post, this may make a more sense if you do that. The graph shows natural, exponential growth. If we would change the time scale to end a century earlier, the curve would look the same, only the historic event would now appear to be in the late 1700's. End another century earlier, and the momentous event still moves back with the new scaling.

There was no event that changed the World population growth rate. Population growth is an example of growth from feedback and this graph is what that curve will always looks like. Small victories in the beginning, remaining small for far longer than our linear minds can imagine, then accumulating faster than linear thinking can grasp.

The two mistakes we can make are to believe the smaller growth rate is failure or to not accept the higher growth rate as success and invest in necessary infrastructure to keep the feedback going. It takes a faith that the returns will really happen to avoid either downfall. Of course this growth doesn't go on forever. There are always limits to growth; however, some are just in our linear minds.

During the Beatles's era, Maharishi Mahesh Yogi, who may have been the subject of their song Fool on the Hill, challenged his followers with the claim that if the square root of 1% of a population practices Transcendental Meditation (TM), crime in the area would decrease. In 1993, TM followers came to Washington DC during a record heat wave (which correlates to increased crime) to create such a critical number. Crime decreased for the period of the experiment. After its conclusion, it increased again.

This is not unique to TM. The story has been repeated in countless endeavors where fools have believed in continuing to repeat something powerful and gentle until the feedback effects can finally be observed; or until their return on investment is finally realized. We live in a faithful (systematic) universe; just not a linear one.

Image credit: mattlemmon

There should be no better investment than one you make in yourself. You are the Active Investment as well as the Active Investor. This blog is about what happens "inside" when you invest in yourself by having your own business. Sometimes it's fulfilling and sometimes it's frustrating. These postings are meant to be companions for the journey.

Tuesday, November 24, 2009

Monday, November 16, 2009

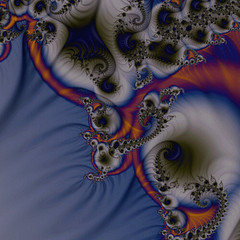

Power Produces Fractal Growth

We can recognize those activities that create lasting values by their systematic characteristics of being repetitive, powerful, and gentle (RPG). This is characteristic of all of God's gifts to us from sunshine and rain to love and joy. These activities are the drivers that raise mountains, carve canyons, build successful organizations, and change societies. If we fill a lifetime with them, we fulfill our destiny and achieve peace.

We can recognize those activities that create lasting values by their systematic characteristics of being repetitive, powerful, and gentle (RPG). This is characteristic of all of God's gifts to us from sunshine and rain to love and joy. These activities are the drivers that raise mountains, carve canyons, build successful organizations, and change societies. If we fill a lifetime with them, we fulfill our destiny and achieve peace.Being powerful is the centerpiece. Exactly what does that mean? To start, the opposite of powerful is not weak, after all, the meek shall inherit the earth. No, the opposite of powerful is forceful.

Force creates change; but only as long as the forces are applied. Eventually they dissipate and the changes are lost. Force does not create lasting values. A deeper explanation of this can be found in Dr. David Hawkin's eye-opening book, Power vs Force.

Powerful activities are simple patterns that have universal application. They are those simple things each of us discover we can do well. Because of their universal applicability, the results of powerful activities build in a replicating, self-similar fashion. What begins to happen is fractal growth, represented by this week's illustration.

Fractals are the design of nature. Think about the shape of a cloud, a leaf, or a sea shell. They don't consist of circles, triangles, or polygons. Mathematicians have discovered these shapes are created when a simple function is endlessly repeated.

Our personal shapes are a good example. We are cellular. Our cells keep repeating (they are good at that) and our shape and capabilities form from that activity. We aren't assembled; we self-replicate and experience fractal growth.

A powerful set of activities is the heart of a good business plan. Is there something universally applicable incorporated into the business plan? Something that will work under alternative circumstances? Are those activities allowed to replicate and grow? If that's the plan, it's one to build lasting values.

Our personal schedules are no different. Am I repeating those powerful things to create success every day? What we are discussing here is both a financial strategy and a moral obligation.

This thinking then moves us to the importance of clear self-direction; and that is the secret of gentleness.

Image credit: SantaRosa OLD SKOOL

Labels:

Business plan,

business plans,

Consulting,

Fractal,

Motivation

Monday, November 9, 2009

The Tao of Active Investing

The principles of building lasting value are timeless and universal. Chwan Tzu, an ancient Chinese philosopher, wrote the following centuries ago. It illustrates the impact of a repetitive, powerful, and gentle lifestyle as described in the Tao, the Chinese book about understanding and joining with natural forces. The story starts when Prince Hui complements his cook on his skills with a cleaver.

The principles of building lasting value are timeless and universal. Chwan Tzu, an ancient Chinese philosopher, wrote the following centuries ago. It illustrates the impact of a repetitive, powerful, and gentle lifestyle as described in the Tao, the Chinese book about understanding and joining with natural forces. The story starts when Prince Hui complements his cook on his skills with a cleaver."Well done!" cried the Prince; "yours is skill indeed."

"Sire," replied the cook, "I have always devoted myself to Tao. It is better than skill. When I first began to cut up bullocks, I saw before me simply whole bullocks. After three years' practice I saw no more whole animals. And now I work with my mind and not with my eye. When my senses bid me stop, but my mind urges me on, I fall back upon eternal principles. I follow such openings or cavities as there may be, according to the natural constitution of the animal. I do not attempt to cut through joints: still less through large bones.

"A good cook changes his chopper once a year -- because he cuts. An ordinary cook, once a month -- because he hacks. But I have had this chopper nineteen years, and although I have cut up many thousand bullocks, its edge is as if fresh from the whetstone. For at the joints there are always interstices, and the edge of a chopper being without thickness, it remains only to insert that which is without thickness into such an interstice. By these means the interstice will be enlarged, and the blade will find plenty of room. It is thus that I have kept my chopper for nineteen years as though fresh from the whetstone.

"Nevertheless, when I come upon a hard part where the blade meets with a difficulty, I am all caution. I fix my eye on it. I stay my hand, and gently apply my blade, until with a whach the part yields like earth crumbling to the ground. Then I take out my chopper, and stand up, and look around, and pause, until with an air of triumph I wipe my chopper and put it carefully away."

"Bravo!" cried the Prince. "From the words of this cook I have learned about the way of life."

A new active investing venture will always go through these 3 stages:

1) Seeing the whole and being confused by all its parts (Learning)

2) Understand the details and complexities (Managing)

3) Knowing exactly what to do from experience (Mastery)

Its comforting to know where we are at any given time and to be prepared to be happy there until we grow into the next stage.

Image credit: silentius

Labels:

active investment,

active investor,

business growth,

growth

Monday, November 2, 2009

The Problem of Original Sin

It's easy to believe and act on the power of good intention and co-creation; yet history and personal experience painfully demonstrate that life just isn't that easy. There is a restraining force that thwarts the co-creative powers of positive intentions and its been present as long as history has been recorded.

We find this force labeled "original sin" in Biblical doctrine. It's a favorite concept for those who wish to argue against Biblical teachings to attack; however, it does seem to explain what happens; so a second look at the mechanics of original sin is in order.

Cognitive scientists study the brain in an effort to understand the mind. Humans have this distinctive ability to be self-aware. We can observe and therefore can also encourage, love, criticize, or despise ourselves. It doesn't appear that other life forms can (or want) to do this. While all life has some form of intelligence, it just usually doesn't have the capability of self-awareness.

In the cognitive studies of the human brain, self-awareness appears to be in a special area of the human brain known as the prefrontal cortex. Unlike a mechanisms subject only to Newton's Laws, humans are not limited to a fixed reaction to an action. We use the prefrontal cortex and its capability of self-awareness to change our response.

Wonderful as self-awareness might be, the thousands of operational details required to maintain human life would simply over-whelm it. Never fear, a subconscious mind rises elegantly and efficiently to meet the need.While the prefrontal cortex is a small part of our total brain, the rest is busy operating all our life functions in an automatic fashion with any conscious direction.

A small portion of this subconscious intelligence is instinct. Most of our automated behaviors are learned. Researchers believe this larger area of our brain takes-in all it experiences as truth from birth until about the age of 6. While this system gives each succeeding generation the opportunity to receive updated lessons in living, the subconscious dutifully records with reason or judgment, often misinterpreting childhood experiences and forming false and/or destructive beliefs. These beliefs primarily come from our parents, who received them from their parents, who received them from generations of parents going back in time until the beliefs associated with original sin were started.

Defining sin is important. It was originally a term used in archery to mean "missing the mark." Original sin is the programming we receive from our ancestry that through our subconscious mental automation causes us to miss the potential we all were given. This definition is not meant to take away the use of the word sin to refer to missing out on God's grace; rather it includes that and more.

Neurologically, 95% of the brain is dedicated to the subconscious. While the remaining 5% can choose to be different, this doesn't happen easily. Corrective beliefs, in the form of new habits, are needed to re-program the subconscious. Forming those habits take the repetitive, powerful, and gentle actions this blog has discussed for Active Investors. Biblically, it is what the work of the Holy Spirit is all about for all of us.

Image Credit: petervanallen

We find this force labeled "original sin" in Biblical doctrine. It's a favorite concept for those who wish to argue against Biblical teachings to attack; however, it does seem to explain what happens; so a second look at the mechanics of original sin is in order.

Cognitive scientists study the brain in an effort to understand the mind. Humans have this distinctive ability to be self-aware. We can observe and therefore can also encourage, love, criticize, or despise ourselves. It doesn't appear that other life forms can (or want) to do this. While all life has some form of intelligence, it just usually doesn't have the capability of self-awareness.

In the cognitive studies of the human brain, self-awareness appears to be in a special area of the human brain known as the prefrontal cortex. Unlike a mechanisms subject only to Newton's Laws, humans are not limited to a fixed reaction to an action. We use the prefrontal cortex and its capability of self-awareness to change our response.

Wonderful as self-awareness might be, the thousands of operational details required to maintain human life would simply over-whelm it. Never fear, a subconscious mind rises elegantly and efficiently to meet the need.While the prefrontal cortex is a small part of our total brain, the rest is busy operating all our life functions in an automatic fashion with any conscious direction.

A small portion of this subconscious intelligence is instinct. Most of our automated behaviors are learned. Researchers believe this larger area of our brain takes-in all it experiences as truth from birth until about the age of 6. While this system gives each succeeding generation the opportunity to receive updated lessons in living, the subconscious dutifully records with reason or judgment, often misinterpreting childhood experiences and forming false and/or destructive beliefs. These beliefs primarily come from our parents, who received them from their parents, who received them from generations of parents going back in time until the beliefs associated with original sin were started.

Defining sin is important. It was originally a term used in archery to mean "missing the mark." Original sin is the programming we receive from our ancestry that through our subconscious mental automation causes us to miss the potential we all were given. This definition is not meant to take away the use of the word sin to refer to missing out on God's grace; rather it includes that and more.

Neurologically, 95% of the brain is dedicated to the subconscious. While the remaining 5% can choose to be different, this doesn't happen easily. Corrective beliefs, in the form of new habits, are needed to re-program the subconscious. Forming those habits take the repetitive, powerful, and gentle actions this blog has discussed for Active Investors. Biblically, it is what the work of the Holy Spirit is all about for all of us.

Image Credit: petervanallen

Labels:

Bible,

Forgiveness,

God,

identity,

Imagination,

love,

Motivation,

prayer,

problem solving,

Self-esteem

Monday, October 26, 2009

Crystallization - Beauty Built On Imperfection

Things are never right. That's what ultimately creates order and beauty with a system. The story of crystallization is a remarkably accurate metaphor for how that happens in a natural system that an Active Investor can readily apply to understanding social systems such as their business.

The orderliness of a crystal begins with the random movements found in liquids. Crystals are created when molecules of a substance, normally solid at room temperature, are dissolved in a solution. These molecules will sometimes be attracted to each other for short periods, only to become attracted away by other molecules over time. Everything remains chaotic and fluid until a "seed", a point of imperfection, is introduced into the solution. The seed has a slightly higher attraction to nearby molecules, so they are drawn to it. If this initial attraction is strong enough, the group grows until its size is such that the group becomes consistently more attractive to other molecules than the surrounding solution. This is the "critical size" and when reached the protocrystal is now "in business" and continues to grow.

All of this is similar to a business during its start-up phase. For a business, the solution is not a liquid, it's the answer to a market need. A good business solution can be replicated and the company providing it begins to experience some repetition of sales. Orders will be slow and random at first; but they will grow with greater consistency over time.

This is not the end of the story. There is another step in the crystallization process. The protocrystal continues to grow ; but eventually it gets to a point it can no longer remain "dissolved" and it falls out of solution. Now the original imperfection appears to have been transformed into the beauty, order, and attractiveness of a visible crystal. The visible crystal continues to grow, gaining more molecules from the solution, until it reaches an equilibrium with its environment.

A growing business will face a second step as well. Meeting more market needs will begin to overwhelm the founding staff and another decision, as difficult as the one to initially start, has to be made. An investment must be made in building internal systems and structures if continued growth is to be nurtured. This is hard for the financially struggling team who have sacrificed for the sake of building their solutions; but out of the internal systems and structures come the power to sustain long term growth.

It's now a different business, one that is building lasting values. Those values will allow it to reach far beyond its initial products and services that brought it to life. A visible legacy drops out of solution.

Image credit: wlodi

The orderliness of a crystal begins with the random movements found in liquids. Crystals are created when molecules of a substance, normally solid at room temperature, are dissolved in a solution. These molecules will sometimes be attracted to each other for short periods, only to become attracted away by other molecules over time. Everything remains chaotic and fluid until a "seed", a point of imperfection, is introduced into the solution. The seed has a slightly higher attraction to nearby molecules, so they are drawn to it. If this initial attraction is strong enough, the group grows until its size is such that the group becomes consistently more attractive to other molecules than the surrounding solution. This is the "critical size" and when reached the protocrystal is now "in business" and continues to grow.

All of this is similar to a business during its start-up phase. For a business, the solution is not a liquid, it's the answer to a market need. A good business solution can be replicated and the company providing it begins to experience some repetition of sales. Orders will be slow and random at first; but they will grow with greater consistency over time.

This is not the end of the story. There is another step in the crystallization process. The protocrystal continues to grow ; but eventually it gets to a point it can no longer remain "dissolved" and it falls out of solution. Now the original imperfection appears to have been transformed into the beauty, order, and attractiveness of a visible crystal. The visible crystal continues to grow, gaining more molecules from the solution, until it reaches an equilibrium with its environment.

A growing business will face a second step as well. Meeting more market needs will begin to overwhelm the founding staff and another decision, as difficult as the one to initially start, has to be made. An investment must be made in building internal systems and structures if continued growth is to be nurtured. This is hard for the financially struggling team who have sacrificed for the sake of building their solutions; but out of the internal systems and structures come the power to sustain long term growth.

It's now a different business, one that is building lasting values. Those values will allow it to reach far beyond its initial products and services that brought it to life. A visible legacy drops out of solution.

Image credit: wlodi

Monday, October 19, 2009

Reptitive, Powerful, and Gentle - Intrinsic Motivation

We sense the motivation of a leader is a step above that of follower. Business owners, managers, and consultants have all wanted to capture some of whatever motivates the leader, The Active Investor, and spread it throughout the entire organization. In an 18 minute TED presentation Dan Pink sheds a bright light on the nature of that difference and what some organizations do about it. His message is that business ignores what science already knows about motivation.

Labels:

key drivers of value,

Motivation,

Self-esteem,

Small business

Monday, October 12, 2009

Did I just screw-up?

Anyone who has never felt this way is a poster child for the unfulfilled life. Remorse is a negative feedback with destructive potential if ignored. It's also the catalyst for developing our potential if accepted and appreciated.

There is a story about a successful Active Investor, a business owner or professional, who was being interviewed. She was asked to revel the secret of her success (a great question networking question by the way). Her answer was that success was the result of not making mistakes. This lead to a question on how to avoid mistakes. Her response was that experience would teach you how to avoid them. The obvious follow-up question was about the best way to get that experience. Her concluding wisdom was that the best way to obtain experience was to make mistakes.

The difference between an accomplished athlete and an amateur is not just natural ability. It's the experience gained from extensive training under the watchful eye of a great coach. Even small mistakes are honed away in hours of work on the practice fields. This repetition of action and corrective feedback gently and powerfully develops the the successful athlete's abilities on the playing field we all admire.

Life doesn't give Active Investors a practice field; but the coaches are very present. Everyone benefits from mentoring. This can be from those who invested themselves in us during our past. It can also be from a current network of professional advisers we can develop. It's feedback necessary for grwoth. Being able to get good coaching is critical; however, these are only our external coaches.

There are also our internal coaches that watch our play and seek to guide us. Remorse is such a coach when we appreciate that it moves us towards better ways to achieve our goals. The feeling, although negative, is there as a driver for improvements that inevitably increase lasting values. The feelings are designed to make us stop. Not for self-pity; but to take a moment to learn from what just happened and to guide change.

Our actions may now forever limit us in the future. Limitations in one area creates opportunities for specialization and excellence in what's remaining. They may be cause for an apology. This starts the miraculous process of healing. But, most of all, they are a basis for us to rise above our past performance levels and become who we feel we should become. We get there by thinking about alternatives to our present situation that will make us feel better. It may happen in a single insightful step. Recovery may also be from one slightly better emotional state to another as we recover over time. However, there is always some better feeling way to think about a remorseful situation and our job is to find and follow it.

Although mentioned in a previous blog posting this bears repeating. The Active Investor's emotional strategy when experiencing negative feedback of any kind should be to move from a position of judgment to a position of curiosity.These negative feelings are our sensors and guides, not our enemies.

image credit: TheeErin

There is a story about a successful Active Investor, a business owner or professional, who was being interviewed. She was asked to revel the secret of her success (a great question networking question by the way). Her answer was that success was the result of not making mistakes. This lead to a question on how to avoid mistakes. Her response was that experience would teach you how to avoid them. The obvious follow-up question was about the best way to get that experience. Her concluding wisdom was that the best way to obtain experience was to make mistakes.

The difference between an accomplished athlete and an amateur is not just natural ability. It's the experience gained from extensive training under the watchful eye of a great coach. Even small mistakes are honed away in hours of work on the practice fields. This repetition of action and corrective feedback gently and powerfully develops the the successful athlete's abilities on the playing field we all admire.

Life doesn't give Active Investors a practice field; but the coaches are very present. Everyone benefits from mentoring. This can be from those who invested themselves in us during our past. It can also be from a current network of professional advisers we can develop. It's feedback necessary for grwoth. Being able to get good coaching is critical; however, these are only our external coaches.

There are also our internal coaches that watch our play and seek to guide us. Remorse is such a coach when we appreciate that it moves us towards better ways to achieve our goals. The feeling, although negative, is there as a driver for improvements that inevitably increase lasting values. The feelings are designed to make us stop. Not for self-pity; but to take a moment to learn from what just happened and to guide change.

Our actions may now forever limit us in the future. Limitations in one area creates opportunities for specialization and excellence in what's remaining. They may be cause for an apology. This starts the miraculous process of healing. But, most of all, they are a basis for us to rise above our past performance levels and become who we feel we should become. We get there by thinking about alternatives to our present situation that will make us feel better. It may happen in a single insightful step. Recovery may also be from one slightly better emotional state to another as we recover over time. However, there is always some better feeling way to think about a remorseful situation and our job is to find and follow it.

Although mentioned in a previous blog posting this bears repeating. The Active Investor's emotional strategy when experiencing negative feedback of any kind should be to move from a position of judgment to a position of curiosity.These negative feelings are our sensors and guides, not our enemies.

image credit: TheeErin

Monday, October 5, 2009

Creating Products from Services

An objective of The Active Investor blog is to inspire the thinking of small business owners and professionals to create greater lasting value in their business. There is perhaps no better way to do this than to find ways to create products from services.

A product without services eventually becomes a commodity with business going to the lowest cost provider. Selling only services is a bit like selling air. You can't really sell time. You can only rent your expertise for some time. Expertise is intangible and difficult to either prove or differentiate and in the end the amount that can be sold is always capped by a time limitation. If you want to sell the enterprise, because it's your expertise and you're leaving, the residual value is relatively small. However, when the business offers a deliverable solution that can be named plus is easy to understand and refer, you have hit a "value-added" sweet spot. Here is a personal example.

Names are important. They give the offering tangibility. As a Texas business broker, I create marketing plans for my clients, as do many other business brokers. Since most small business buyers come from the internet, this plan includes multiple internet directory listings, which again, other brokers do. So far, we're still at the services level. I've then created a unique product offering on top of these services named Business Opportunities Bulletins (BOBs). With some creativity and technology, each client listing can appear on the first Goggle results page of significant search terms used by potential buyers. If a client wants to be found by potential business buyers, here is a product, a BOB, that does exactly that.

A BOB is easy to understand. The art of selling your business is to be presented to interested parties and still keep the sale confidential. Prospective clients can see how this is already working for existing clients. They "get it" immediately.

In this example, the product's name is a take-off of my own name. If a need for my business broker services gets touched upon by someone in my network, it's easy for them to explain and refer my product (my service).

Building BOBs takes time, expertise, and technology but their existence adds critical value both to immediate marketability and to the ultimate value of the brokerage practice. A product has been created out of services common to the industry. How many products can be developed from your services? Something with a name that is easy to understand and refer. I can't image anyone who can't develop at least one more.

Image credit: EraPhernalia Vintage (catching up)

A product without services eventually becomes a commodity with business going to the lowest cost provider. Selling only services is a bit like selling air. You can't really sell time. You can only rent your expertise for some time. Expertise is intangible and difficult to either prove or differentiate and in the end the amount that can be sold is always capped by a time limitation. If you want to sell the enterprise, because it's your expertise and you're leaving, the residual value is relatively small. However, when the business offers a deliverable solution that can be named plus is easy to understand and refer, you have hit a "value-added" sweet spot. Here is a personal example.

Names are important. They give the offering tangibility. As a Texas business broker, I create marketing plans for my clients, as do many other business brokers. Since most small business buyers come from the internet, this plan includes multiple internet directory listings, which again, other brokers do. So far, we're still at the services level. I've then created a unique product offering on top of these services named Business Opportunities Bulletins (BOBs). With some creativity and technology, each client listing can appear on the first Goggle results page of significant search terms used by potential buyers. If a client wants to be found by potential business buyers, here is a product, a BOB, that does exactly that.

A BOB is easy to understand. The art of selling your business is to be presented to interested parties and still keep the sale confidential. Prospective clients can see how this is already working for existing clients. They "get it" immediately.

In this example, the product's name is a take-off of my own name. If a need for my business broker services gets touched upon by someone in my network, it's easy for them to explain and refer my product (my service).

Building BOBs takes time, expertise, and technology but their existence adds critical value both to immediate marketability and to the ultimate value of the brokerage practice. A product has been created out of services common to the industry. How many products can be developed from your services? Something with a name that is easy to understand and refer. I can't image anyone who can't develop at least one more.

Image credit: EraPhernalia Vintage (catching up)

Monday, September 28, 2009

A Farewell to Time Management

For decades there was a focus on Time Management. It was a belief that we could become more productive, and therefore happier, if we could only optimize the use of our limited time. Initial efforts were centered on the process of scheduling. The problem with scheduling people's time (as opposed to a machine's time) is that while it may keep you busy, it doesn't necessarily make you effective.

For decades there was a focus on Time Management. It was a belief that we could become more productive, and therefore happier, if we could only optimize the use of our limited time. Initial efforts were centered on the process of scheduling. The problem with scheduling people's time (as opposed to a machine's time) is that while it may keep you busy, it doesn't necessarily make you effective.Personal scheduling gave way to Prioritization in the schools of Time Management. Doing the most important things turns-out to be much more effective than doing the greatest number of things. Thus Prioritization soon lead the way to Goal Setting, Mission Statements, Core Competencies, etc.

It was very effective, very profitable, and fun for a while. After the innovation wore off, 20th century productivity went back to feeling like the same old grind, just a bit more productive - but not enough to take us to the levels we had hoped to achieve.

The question has now become, how can we preserve that "innovation" stage where our efforts were effective, profitable, and fun? It's most easily recognized by feelings associated with Energy. When we're in that kind of state things happen in a tireless and joyful fashion. The issue now facing the 21st Century Active Investor is how can we manage to keep our personal Energy at those levels?

I have been enriched by the opportunity to drive to Snyder for a client. After passing the city of Sweetwater you enter Texas oil country. Here Texans have lived to bring us the Energy from fossil fuels underground that have driven our economy. But on this drive, you won't give oil a thought. What you see is miles and miles of windmills harvesting Energy from the air. If we told our ancestors we could get Energy from just the air they would have considered us mentally unstable; but today it's everywhere on the road to Snyder.

This is a metaphor for 21st Century Personal Energy Management. We don't have to go to great lengths underground to get a limited supply of Energy; it's abundantly available in our environment. The challenge is to harvest it. Windmills reach out their arms to be driven by the air moving in their environment. In a similar fashion we have to create processes that enable us to reach out and catch the Energy moving in our environment.The place to start is to acknowledge what causes our feelings to be high or low. Typically positive or negative perceptions of our environment create high and low feelings of Energy respectively; however each of us have our own Energy attractors.

With this internal guidance system in place, Active Investors can began to recognize those activities, people, and places that either drain or renew their Energy. Our personal Energy supply is both apparent (from our feelings - our internal guidance system) and abundant (from our environment - if we can recognize it). Our 21st Century challenge is now to manage our Energy by knowing how to continually reach out for more.

Image credit: goosegrease

Labels:

21st century,

active investor,

time management

Monday, September 21, 2009

Shaping the future

In President Obama's address to Congress on Healthcare this month, he reminded them that they came to Washington not to fear the future but to shape it. What an inspirational remark and what a great definition for an Active Investor. Active Investors are more than just business owners and professionals; they are the individuals who have made a decision not to fear their future but to take responsibility to shape it.

Once we get beyond the inspirational feelings of that remark, we're left with the reality of exactly how does one go about shaping their own future? For Congress and Healthcare, it involves agreeing to passing enabling legislation. What's involved for us as individuals?

We cannot know the future; however we can understand it through System Dynamics. Our core principle is structure will determine behavior. The future will play-out according to the structures at that time. Our nation will have better Healthcare if a better Healthcare system is in place. An Active Investor will have a more successful business if better business structures are in place.

Each day is a new opportunity to:

1) Faithfully respond to the needs currently presented to us, and

2) Imagine how we can build structures to be even better in the future.

This is a big step beyond "making money." This is building lasting value. The profits earned at any given time will be consumed; but the structures are a lasting value. We see this in business brokerage all the time. Business owners who have created structures cash out handsomely. Those that have just made money get by.

Shaping our future is building our structures. What marketing, sales, management, HR, compliance, fulfillment, etc. resources need to be in place for our complete success? This question is never conclusively answered in our expanding universe. The mere passage of time is enough to continually create new opportunities for everyone. New structures will first form in our minds and later find their way into our reality - shaping our future.

As for politics, our President's speech did affect me. I've decided to believe there is a viable solution to the nation's Healthcare problem. Congress only has to imagine it.

Image credit: dmitryku

Once we get beyond the inspirational feelings of that remark, we're left with the reality of exactly how does one go about shaping their own future? For Congress and Healthcare, it involves agreeing to passing enabling legislation. What's involved for us as individuals?

We cannot know the future; however we can understand it through System Dynamics. Our core principle is structure will determine behavior. The future will play-out according to the structures at that time. Our nation will have better Healthcare if a better Healthcare system is in place. An Active Investor will have a more successful business if better business structures are in place.

Each day is a new opportunity to:

1) Faithfully respond to the needs currently presented to us, and

2) Imagine how we can build structures to be even better in the future.

This is a big step beyond "making money." This is building lasting value. The profits earned at any given time will be consumed; but the structures are a lasting value. We see this in business brokerage all the time. Business owners who have created structures cash out handsomely. Those that have just made money get by.

Shaping our future is building our structures. What marketing, sales, management, HR, compliance, fulfillment, etc. resources need to be in place for our complete success? This question is never conclusively answered in our expanding universe. The mere passage of time is enough to continually create new opportunities for everyone. New structures will first form in our minds and later find their way into our reality - shaping our future.

As for politics, our President's speech did affect me. I've decided to believe there is a viable solution to the nation's Healthcare problem. Congress only has to imagine it.

Image credit: dmitryku

Monday, September 14, 2009

On The Edge of Space and Time

Using the image on the left as a guide, image a metal plate with a hole in the center that is being heated. We know that heating metal causes it to expand , so the arrows indicate how the plate will expand. The question is what will happen to the hole? Will the forces applied cause it to get bigger or smaller?

Using the image on the left as a guide, image a metal plate with a hole in the center that is being heated. We know that heating metal causes it to expand , so the arrows indicate how the plate will expand. The question is what will happen to the hole? Will the forces applied cause it to get bigger or smaller?Please take a moment to to quickly decide on one of the following positions before reading further:

1) The hole will get bigger

2) The hole will get smaller

3) I'm just not sure

Let's ask the same question in a different manner. Suppose there is a bolt stuck in a metal hole. If the metal is heated, will that loosen the bolt and make it easier to remove? Yes or No?

Generally, looking at the arrows in the diagram causes confusion. They all appear to be pushing against the diameter of the hole in a way that should make it smaller. Yet that just doesn't feel like a right answer and Position 3, being not sure, is a typical first reaction. Asking essentially the same question without the "helpful" diagram is much easier to answer. Even the mechanically challenged, like myself, imagine the bolt getting looser as the metal heats. The correct answer, which we all intuitively know, is heating the metal plate will cause all dimensions to increase, including the hole's.

Why is it difficult for most of us to quickly see what we know as obvious in that problem? This is really an illustration of two principles. The first is we tend to make decisions using an "Anchor and Adjust" strategy. In this case, the misleading illustration was put first to set it as a mental "Anchor". Then when we try to answer by Adjusting from that image, we run into difficulty because of the apparent shrinking effect of the arrows. Anchor and Adjust is very powerful and will be described further in future postings. The other principle is that even though we know this is an expanding universe, we are easily suckered into acting as if it were shrinkable.

The general acceptance of Hubble's Law and The Big Bang Theory has spread the knowledge that the universe must continue to expand; however, we tend to think of that as something only related to astronomy. Each of us are on the very edge of the space-time continuum and each passing moment of our lives moves our edge further outward. A popular metaphor is to imagine an ant on a balloon. Our ant's "space" (along with all the other ants) in space-time must expand as the balloon of the universe inflates (expands). We are all always in a place of expansion. The universe has no other way of acting. No matter how it appears, it's just not shrinkable.

The Active Investor, a business owner or professional, initially believes in an expanding universe. Time and circumstances wear on us all and we all eventually face "arrows" that indicate we were wrong about the universe. If that conclusion just doesn't feel right, there is every good reason to believe it's just so much junk science obscuring the truth. A suitable path out of the circumstance is to take gentle yet powerful actions that do feel right and to repeat them until feelings coincide with situation.

This blog is written to inspire good feeling thoughts that lead to actions. They will manifest themselves if we seek them. They have to. It's our part in the expansion of our edge of the universe.

Labels:

active investor,

Anchor and Adjust,

Imagination,

Physics,

possibility,

Self-esteem

Friday, August 28, 2009

An Item of Interest

Networking is popular these days because it's inexpensive and meaningful. Email, the killer app that propelled global acceptance of the internet, was the same way. Today email filtering companies report that over 90% of all email on the internet at any given time is spam. Can networking be headed in the same direction?

Networking is popular these days because it's inexpensive and meaningful. Email, the killer app that propelled global acceptance of the internet, was the same way. Today email filtering companies report that over 90% of all email on the internet at any given time is spam. Can networking be headed in the same direction?Networking advisers universally maintain that the group meetings are just the tip of the networking iceberg. The real work is accomplished at subsequent one-on-one meetings where individuals meet to discuss if the person they are meeting is someone they can refer to others.

We all want to be trusted advisers and the only way to get there is to have a history of delivering results. Even if you do not personally deliver the final solution, if you have started the solution with an on-target referral, you build trust. This means even if your practice cannot solve every problem you encounter in the market, if you can refer to others who do solve them, you build trusted adviser credentials.

As Active Investors meet one-on-one, they seek a knowledge of reliable solutions to problems their business cannot deliver. The size of their referral network will determine how frequently they can help others generate results, and thereby earn trust.

Relationship marketing has also been popularized as a way to build trust. People prefer to to business with those they know. What confuses many in networking is that this is true but incomplete. People prefer to do business with those they know and trust. The objective of the Active Investor's networking activities is not relationship building. It's the sharing of problem solving capabilities.

Salesmen look for items of interest to bring to meetings. These items give the encounter meaning and dramatically increase the chances of a sale. The item of greatest interest that an Active Investor can bring to a networking one-on-one meeting is a credible solution to a problem our networking partner might encounter. Our personal history, scope of practice, family, hobbies, etc. are nice to discuss but they're of little benefit to our partner's ability to build trust.

Preparing for any business meeting, networking or otherwise, could include a simple exercise. Look at both palms and ask yourself a question, "Am I bringing an item of interest, or am I bringing spam?"

(The blog photo was chosen because in a one-on-one meeting with the Texas networking mentor Jeff Weaver I was insisting that items of interest had to be specific to each individual. Jeff told me about successfully using a history of Valentine's Day as an item of interest on a general basis. The picture comments on Flickr also support how interesting many others have found this related image to be. It looks as if love just might be a universal item of interest. John 13:34,25)

Image credit: naama

Labels:

Business,

business growth,

love,

marketing,

Marketing and Advertising,

networking,

referrals,

Spam

Thursday, August 20, 2009

Powerful Symbols of Structure

Today's performance is the result of the strategic resources we had available when we woke-up this morning. Toyota will build many more cars today than I will because they have the resources and intent to do so and I don't. On the other hand, Toyota's contribution to this posting will be a mere mention of their name. My contribution will be its creation because I have access to these resources.

Today's performance is the result of the strategic resources we had available when we woke-up this morning. Toyota will build many more cars today than I will because they have the resources and intent to do so and I don't. On the other hand, Toyota's contribution to this posting will be a mere mention of their name. My contribution will be its creation because I have access to these resources.Structure determines behavior. In our past we have intended certain results which has caused the accumulation of necessary resources to accomplish them. These resources for an Active Investor might include things like cash, reputation, customer base, staff, inventory, equipment, technology, supplier relationships, and so forth. What happens in the present is the unfolding result of the levels and structures of our current resources. This is why accounting and business valuations work in the present. We can accurately know our resources as they exist now. Forecasting future performance is another matter.

Financial methodologies are scalable to almost any level of detail complexity; however, they are often not well suited to deal with dynamic complexity. As we move out of the known present and into an unknowable future, resource levels will be dynamically affected. Things will generally not happen in a linear fashion like we tend to imagine. Understanding the dynamics of how we arrived at the present is far more valuable in forecasting than understanding the details. Unfortunately, the study of system dynamics is somewhat challenging (although if it's possible, an Active Investor will greatly benefit from taking a formal system dynamics course).

The rest of us take an intuitive shortcut. We look for symbols that indicate the underlying structure and use that to get clues about dynamics.

Experience in audit and business brokering have helped me develop a sense of symbols. Walking into a business the cars in the parking lot may be symbols that the owner (and therefore the business) is doing well. The maintenance is a symbol of their attention to detail. The decor may become symbolic of their perceived customer preferences.

For all the time and effort spent on marketing assets, it's often our symbols that communicate the most about us to others. They are most powerful communicators that indicate our structure and will be used by others to predict our future behaviors.

Our symbols are both advantageous and dangerous because they communicate instantly. And yet, we frequently are not even aware of what symbols we currently display. The Active Investor benefits from paying attention to them. It takes an examination of our structures to best see our symbols. By being alert to symbols in our markets, we learn both about others and how to better present ourselves.

Image credit: avixyz

Friday, August 14, 2009

Entrainment - Power in Prayer and Meditation

An emerging theme in this blog is identifying key drivers of value by recognizing 3 necessary characteristics. Value Drivers of lasting consequence can be recognized because they are always Repetitive, Powerful, and Gentle (RPG). Certainly prayer and meditation are candidates. They are Repetitive and Gentle; but what about Powerful? A part of their Power may lie within an effect scientists have called entrainment.

An emerging theme in this blog is identifying key drivers of value by recognizing 3 necessary characteristics. Value Drivers of lasting consequence can be recognized because they are always Repetitive, Powerful, and Gentle (RPG). Certainly prayer and meditation are candidates. They are Repetitive and Gentle; but what about Powerful? A part of their Power may lie within an effect scientists have called entrainment.Entrainment is the stuff of scientific legend. That legend goes back to 1666. The noted Dutch physicist, Christiaan Huygens, had to adjust the clock in his study each day because it ran about a minute slower than the one in his living room. Both were governed by swinging pendulums. One day he moved them side-by-side. With no other adjustments, the clocks began to keep synchronized time. Any discrepancies disappeared. This observation lead Huygens to the discovery or labeling of entrainment, which is the tendency for adjacent oscillating systems to synchronize.

Where ever there are cycles (Repetitions) there is the potential for the effects of entrainment. The clocks are an example of entrainment in a mechanical system. A striking example in natural systems is the synchronization of menstrual cycles among women who live or work together.

Entrainment is a Powerful effect. Can that power be accessed by prayer and mediation? For one oscillator to affect another, the entrainment has to operate through some medium. Call it the universe, God, or the Zero Point Field, we all must be connected for this scientific effect to occur.

Now consider the processes of prayer and mediation to be bringing yourself side-by-side with God. As you repeat these processes entrainment begins it's subtle work which ultimately results in the changes we call answered prayer. Was the change in the universe, or was it inside of us? Entrainment leads us to the possibility it could be either or both.

Jesus instructed the we should ask to receive (Matt 7:7). His half-brother James later wrote that we can ask but not receive because of our motives (James 4:2). Apparently asking works, but only when a level of entrainment with God has synchronized our motives.

Active Investors have very busy schedules. Repetitive prayer and mediation takes away available time; but if ignored, what will our lives synchronize toward?

Image credit: theilr

Thursday, August 6, 2009

Intention and the Cooperative Universe

A new discipline has emerged this century, the study of Intention. It's often discussed as the Attraction Principle which asserts we attract into our lives those things we dwell on. Examples include if our thoughts are about physical ailments, or poor finances, or an unsatisfactory performance, we will attract poor health, lack of funds, and below standard performances. Alternatively if we genuinely intend good health, abundant finances, and superior performance, these will be what is attracted to us. By itself, the Attraction Principle might be just a sophisticated form of self-delusion; however, in literature such as The Field by Lynne McTaggart evidence is being assembled from advances in quantum physics that provide a scientific basis for its validity.

A new discipline has emerged this century, the study of Intention. It's often discussed as the Attraction Principle which asserts we attract into our lives those things we dwell on. Examples include if our thoughts are about physical ailments, or poor finances, or an unsatisfactory performance, we will attract poor health, lack of funds, and below standard performances. Alternatively if we genuinely intend good health, abundant finances, and superior performance, these will be what is attracted to us. By itself, the Attraction Principle might be just a sophisticated form of self-delusion; however, in literature such as The Field by Lynne McTaggart evidence is being assembled from advances in quantum physics that provide a scientific basis for its validity.There is a strange outcome to the Heisenberg Uncertainty measurement problem that results in energy remaining after temperatures reach absolute zero. I was taught absolute zero meant no atomic motion and therefore no energy and scientists of the last century "normalized" their calculations by simply subtracting this away as "background noise". This may have been an over-simplification. When some physicists keep this energy, now called the Zero Point Field (ZPF), in their equations, it appears the discrepancies between classic and quantum physics are resolved. After further study, it appears the ZPF may be a source of abundant, ever-present energy our advancing civilization will surely require. One estimate is that the ZPF energy in one cubic meter of "empty" space would be sufficient to boil all the oceans on our planet. For Stargate Atlantis fans, this is the energy source behind their Zero Point Modules (ZPMs).

This ever-present field appears to be influenced by everything within it and in turns is an influence on everything in the universe. Scientists are now trying to study how one or more individual's Intentions can be "transmitted" through the ZPF. In many of these studies, the universe responds to the changes in the ZPF and appears to cooperate with the Intention.

The science of Intention does not fit well with mainstream paradigms and is currently relegated to the fringes of the scientific community. Yet the research continues and evidence that the universe cooperates with deeply held Intentions continues to accumulate. The research itself has been attractive to physicists, theologians, philosophers, healers, the military, and many others. It ought to be of interest to the Active Investor as well.

The forces around us shape our destinies, yet from this research we learn that we also shape those very forces. Since we see Intention also has all the characteristics of a force to build lasting value, it's repetitive, powerful, and gentle. The Active Investor should be a student in learning to harnessing its potential.

Photo Credit: EraPhernalia Vintage

Monday, July 27, 2009

The Fair "Quantum" Value of a Business

Edwin Schrodinger used a famous thought experiment to try and explain part of Quantum theory. The experiment placed a cat (now known as Schrodinger's Cat) in an unobservable place where after some time there was a 50/50 chance the cat would be either dead or alive. Quantum theory considers the cat to be in a state that is both 50% alive and 50% dead until an observer sees the results. At that time, the probability fields collapse and the cat is either alive (although quite annoyed) or has forever passed on.

Edwin Schrodinger used a famous thought experiment to try and explain part of Quantum theory. The experiment placed a cat (now known as Schrodinger's Cat) in an unobservable place where after some time there was a 50/50 chance the cat would be either dead or alive. Quantum theory considers the cat to be in a state that is both 50% alive and 50% dead until an observer sees the results. At that time, the probability fields collapse and the cat is either alive (although quite annoyed) or has forever passed on.This finally answers the ancient philosophical question if a tree falls in the woods and no one is around to hear does it make a sound? We now know that the answer is "probably".

The IRS has defined a term Fair Market Value in Revenue Ruling 59-60 as:

"... the amount at which property would change hands between a buyer and a willing seller when the former is not under and compulsion to buy and the later is not under any compulsion to sell, both parties have reasonable knowledge of the relevant facts."

Such a simple definition creates many probabilities. The least useful are a seller's hope of how much it could be worth and a buyer's hope of how little. There are 3 reality-based paths to approaching the problem:

1) Asset Approach - the replacement cost not considering earning power

2) Income Approach - a discounted estimate of future cash flows

3) Market Approach - comparisons of similar businesses which have sold in the past.

Each of these methods have multiple methodologies which all yield different results and all of them have their appropriate application for specific buyer and seller circumstances. It is the job of the evaluator to accurately assess values based on all of them and then create the combination of probabilities that best represent the scenario described in IRS 59-60. They have to value the state of Schrodinger's cat before the observation. It's a professional opinion that needs to be done by a CPA Accredited in Business Valuation (ABV) or a Certified Valuation Analyst (CVA).

A survey by Inc magazine concluded the 75% of privately held businesses listed for sale do not successfully change hands. The culprit is generally the price. The seller has one probably in mind and the buyer another and they cannot agree. A certified Fair Market Value creates a common anchor for both parties to use in coming to an agreement. Having this common anchor creates the quantum Probably Field that almost always leads to agreement and a successful business sale.

What has happened is the intense observations already done during the valuation pre-collapse the quantum probably fields to a region known to be acceptable to the seller and limiting to a buyer. It's interesting how the intricacies of sub-atomic particles mirror the intricacies of complex business transactions, yet it's all the same universe always acting in the same way.

Image Credit: skuds

Friday, July 24, 2009

Critical Point Analysis

Clockworks have long been metaphors for systems in general. They illustrate energy transformation, cyclical behaviors, information encoding, and much more. One aspect of systems they clearly illustrate is the existence of a critical point.

Clockworks have long been metaphors for systems in general. They illustrate energy transformation, cyclical behaviors, information encoding, and much more. One aspect of systems they clearly illustrate is the existence of a critical point.Imagine the power involved in controlling the heavy hands of a large tower clock. The drive gears must exert crushing force to keep the hands at exactly the correct position. A critical point analysis of the clockworks would be an effort to find a point in the system where the movement of those hands could be stopped with only the pressure from a single finger. In this example, it's the flywheel. Stop the flywheel and everything else halts. That's a critical point and it's the spot of greatest advantage to any planned system intervention.

Business is an incredibly complex system with hundreds of gears (relationships) that mesh together to make it work. The idea that a critical point may exist in a business is difficult to prove; but since the clockwork metaphor seems to be working, it's worth exploring. If there was a critical point in a business, how could we identify it? What would it look like?

Within the clockworks the parts with the greatest mass and largest energy requirements, the hands, are also also the slowest moving. Our critical point, the flywheel, has little mass but is in continual motion. The critical points exhibit speed and repetition but not a lot of substance.

These characteristics are what make ideas critical points. Once an idea starts to spread, the heavy hands of execution begin to move. Internet and advertising consultants tell us extended repetition of a message (the idea) is far more powerful than a single large presentation. A business works because the people involved believe in it.

Critical points have the same characteristics we've already found in the powerful creative forces of nature. They are Gentle, Powerful, and Repetitive. When we find a critical point and dedicate ourselves to it, like an Archimedes who has finally found his place to stand, we can move our world.

Image Credit: poltag

Wednesday, July 8, 2009

Our Invitations

Invitations take many forms, from the formal printed style seen here to the subtle courting signals every society develops. They are powerful tools that open the doors of significant relationships and because of that we handle them with great respect.

Invitations take many forms, from the formal printed style seen here to the subtle courting signals every society develops. They are powerful tools that open the doors of significant relationships and because of that we handle them with great respect.Every piece of marketing material should be considered an invitation. We invite the market to experience our product or service; however it's often done in a strange manner. We use a cost benefit analysis approach. There is no doubt that before an invitation to do business is accepted, a prospect will consider costs and benefits; but to base the invitation on this design dehumanizes the prospect and commoditizes the business.

Imagine being an Event Planner rather than an Active Investor developing a marketing strategy. Successful events always have a feeling that is forever kept in the attendees memories. We often forget the details about exactly what happened at an event; but we will continue to remember how it made us feel. Business transactions are similar social events, especially those of an introductory nature. As we are invited to potential business opportunities feelings are remembered as much as any transactional benefits.

Since advertising and networking have become facts of life in American business, we're all continually exposed to them. They are forms of invitations. What will be remembered is how they make us feel. No matter how timely or creative it might be, unsolicited email feels like spam - disrespect and nothing else. On the other hand, even the coldest of calls that includes a sincere request for advise feels like appreciation. Invitations invoke our feelings.

In response to our rhetorical question, "Do you need a written invitation?" the answer is generally "It certainly wouldn't hurt."

Image Credit: Matt Biddulph

Sunday, July 5, 2009

Risk and Reward

Every investor, active or passive, has in mind a financial risk/reward relationship. They have to decide exactly what degree of risk they are willing to accept in exchange for higher rewards. Passive investors generally see single digit returns these days which is one reason why there is so much interest in the much higher returns of your own business.

Every investor, active or passive, has in mind a financial risk/reward relationship. They have to decide exactly what degree of risk they are willing to accept in exchange for higher rewards. Passive investors generally see single digit returns these days which is one reason why there is so much interest in the much higher returns of your own business.So why doesn't everyone want to jump on higher returns? Passive investors (people who invest in someone else's business) only concern themselves with financial risk. Running your own business also creates another form of risk, personal risk. When you're in charge, not every effort is going to work the way you planned. You can be rejected (or more accurately, you will be rejected). You are subject to frustration and self-doubts. These are just some of the personal risks each Active Investor much face.

Is it worth it for just the financial rewards? That will depend on the circumstances. What is always true is that overcoming personal risk produces personal gains of enormous benefits. In countless biographical examples, people with great satisfaction from their lives have all overcome personal challenges. Active Investors assume a double risk and receive a double reward. Both their financial and personal net worth evolve.

So what can we do about Risk Management when the topic is Personal Risk as opposed to Financial? As I was writing this posting (talk about JIT) I meet with Jeff Weaver, a Texas serial entrepreneur who spends a great deal of his time coaching and mentoring others in addition to developing his own businesses. His strategy is to move out of judgment and move into curiosity.

We worry about that last phone call or meeting. Did we say the right thing? Were we weak, or were we offensively pushy? Are these the right people? Are we doing the right thing? Every one of these internal questions comes with an implicit self-critical negative answer. That's our humanity (Ego) at work. It's what Jeff means by judgment. What if that changed to personal curiosity? We can be equally curious about that last encounter. We can review it with a sense of wonder about what will happen next. Who will we meet as a result? What will they tell us now? What new opportunities have started to emerge?

When we learn to think this way instinctively, Personal Risk converts to Personal Adventure. That's a good thing.

(For those with an interest in how this works out on a theological level, try applying it to the Kingdom Parable in Matthew 18:23 -35. An attitude of curiosity encourages a spirit of forgiveness.)

Image Credit: thegoldguys.blogspot.com/

Finish Strong

I can still remember the game that made me a Dallas Cowboys fan for life. I was eleven years old and living in Houston. At that time Texas had the semi-pro Texas baseball league; but there were no major league teams in any professional sports.

I can still remember the game that made me a Dallas Cowboys fan for life. I was eleven years old and living in Houston. At that time Texas had the semi-pro Texas baseball league; but there were no major league teams in any professional sports.It was 1960 and the NFL announced the formation of the Dallas franchise. The original Cowboys were selected from "unprotected" players on other teams. They were also the unlucky 13th team in the league.

Frustration was the reward for following the Cowboys that first season. They could lead for 3 quarters but NEVER win, including giving up 17 points in the last 6 minutes of their first encounter with San Francisco.

After 10 consecutive losses we were thankful the season had only 12 regular games. Game 11 was against the New York Giants, where our Head Coach Tom Landry had been an assistant coach the previous year.

Even with a slow start, the Cowboys managed to stay in this game, catching up to the Giants but never able to stay there. The 4th quarter began with another Cowboy's come back to tie the game 24 - 24. The reigning conference champion Giants didn't let that last. Soon they had the game back with a 31 - 24 lead. With 2+ minutes left, the Cowboys took advantage of a New York fumble and scored. It was 31 - 30 in the final moments of the game with Fred Cone lining up to attempt the extra point. None of us listening to the game dared to even think about what might happen. The ball was snapped, placed, and kicked through the uprights. We had tied, 31 - 31! It was the first major league professional game Texas had not lost. We had a right to be there; and I was now a Cowboy's fan for life, even though I wouldn't live in the Dallas area for another 30 years.

Everyone knows we should finish strong. That gets confused with winning and it's not the same. Every transaction can end with increased value, even if the result is not what we had in mind. An Active Investor is alert to any value that can be gained; no opportunity need be wasted. If nothing else, can a final result create an increase in trust between us? There is always an audience; will our finish create fans?

No, the Cowboys didn't win that game (or any 1960 game, the season was 0 - 11 - 1) but they had what it takes to finish strong. That won them their original lifetime fans. No, the Texans didn't win at the Alamo; but they won many hearts and we will always remember. They finished strong and that spirit was later at San Jacinto where a vastly out-numbered Sam Houston defeated Santa Anna with courage more than military strength.

We can't count on always wining. We can always intend to finish strong.

Image Credit: sidurkin

Labels:

Business plan,

business plans,

courage,

Dallas Cowboys,

focus,

Self-esteem

Sunday, June 28, 2009

Our Highest Calling

Image by Getty Images via Daylife

Image by Getty Images via Daylife

People associate known good or bad qualities in one area to other areas. They think that because someone is attractive they are also resourceful and honest. They will be suspicious of another if they simply know nothing other than they are poor. This is the halo effect. If you have a positive image in one area, a halo will create a positive image elsewhere.

Being exceptional in one area calls for a focus on it. The fear is that a narrow focus will limit business and cripple profitability. Not always. People's tendency to associate can continue to work to the Active Investor's advantage. If a business demonstrates competence in a complex or unusual area, customers will assume their competence in simpler and more common aspects of the business. The art of profitable focus (halo building) is to choose to build your reputation of excellence in the most complex or unusual area where you can still prove your excellence. Without your drawing attention to any other aspects of the business, prospects will simply assume they have been handled with the same degree of professionalism.

When traveling Interstate 35 through Texas, stop in the town of West. Along the east service road are 3 gas stations, each with a large marque sign competing for your business with major oil company brand recognition and current pricing. At this level they seem similar; however, one of them has so many cars parked there, they have purchased the lot next to them to handle the frequent overflow. This business also sells kolaches. They've created so many delicious varieties the crowds of travelers come without a thought of a major brand or the current pricing. Any travelers new to kolaches see those crowds and assume if they're that popular, these have to be worth buying.

The Cost of Goods Sold for a kolcahe is small change; but what has been achieved by a successful focus on the unusual is worth millions. What should be our focus? What is our highest halo? The answer also is our highest professional calling.

Labels:

business growth,

Business plan,

focus,

marketing,

sales

Monday, June 22, 2009

Choice of Entity

Image by Raymond Yee via Flickr

Image by Raymond Yee via Flickr

A lawyer will seek to aggressively protect their client, including recommending a business form that will provide the best shielding for personal assets. While this is prudent, you should never fall into the illusion that a chosen entity type adequately protects you from potential legal actions. Many attorneys have been successful in proving an entity has not been maintained according to state law and this has exposed the owners personal assets to their complaint. Be aware of the liability protection a business entity can provide; but never depend solely on that. There are two things every business should maintain to protect the owner from liability - a passion for excellence (quality) and insurance. If these are not both built into the heart of any business plan, then there is an argument that the best choice of entity is employee.

Before discussing tax ramifications, there is also an issue the potential Active Investor should consider. It's been said 85% of the workforce are employees, 14% are self-employed, and 1% are business owners. Are you changing from employee to being self-employed or to being an owner? If the goal is to build and own an organization, tax considerations are somewhat different from trying to minimize a self-employed professional's tax exposure. Working out of a normal (C) corporation can create double taxation for the self-employed, which is very undesirable. Some type of "flow through" entity is often recommended. However, if the objective is to build an organization, the funds to grow the business need to come from future company profits. The C corporation has a low (15%) tax rate for it's first tier. This allows the small business to retain some earnings at that low tax rate for growth. If the profits would "flow through" to the owner to avoid double taxation, those funds for growth are effectively taxed at the owner's tax rate. Different intentions create very different tax strategies.

There are many more considerations that need to be considered with an attorney and tax professional. Successful business people often attribute much of their success to having a winning team of trusted advisers who have guided them through these and other issues. However, the secret of the adviser's success is having a client who has thought through what they really want and can give those advisers clear directions.

Friday, June 12, 2009

Sixty and the Pursuit of Happiness

Image via Wikipedia

Image via Wikipedia

Who outside our family doesn't also deserve the same? Nothing ever turns out the way we imagined. Stopping our Imagination, depicted in the picture posted here, is to stop living. It's only from imagination we enable creativity, growth, and hope. We can't go far on sheer will power; but our imaginations can fuel anything. The inevitable frustration and disappointment that an active imagination will cause requires we also extend our forgiveness to all involved. Anything less permanently disables our future happiness.

This is a lot easier to understand than to practice. The root of unforgiveness seems of reside inside of us. The fundamental attribute error that plagues our relationships with others is also nurtured in our self-recriminations. Ridiculous as it sounds, we take the position that we're not worthy of ourselves. With that absurdity firmly in place, we're now perfectly aligned to ruin our lives and the lives of those around us. Self forgiveness requires a large degree of self respect.

In the history of humanity, nothing has lead people to acknowledge their self-worth more than a belief that God resides within them. We know ourselves too well to completely trust us; but we can trust God within us.

I've just turned 60 and that called for some reflection. Before 30, happiness was found in experiences. After 30, the experiences needed meaning, so goals and growth processes became more important. Today the meanings need to be significant, that is from God within. Being able to forgive what's not that, seems to free all that is.

Labels:

Forgiveness,

God,

Holy Spirit,

identity,

Imagination,

Self-esteem

Friday, June 5, 2009

Market Trust

Image by Lorenia via Flickr

Image by Lorenia via Flickr

Mature successful firms get most of their business from repeat customers or referrals from satisfied clients. Trust has been earned in prior dealings. Here the driver of continued success is the customer service staff. They are the guardians of market trust and need to be in close contact with the marketing staff. Social networking is providing marketing with a new generation of tools to measure customer service effectiveness and satisfaction. These departments work together to preserve existing trust.

Newer and smaller firms, more likely to be run by an Active Investor, may not have this kind of staff and or large base of past customers. Trust needs to be developed. How can a business reach out to the market in such a way that both trust and awareness are developed? A system dynamics approach is to look at trust as a resource, that is a stock of something that has a level that can go up and down, and then consider what are the drivers that will increase its level. Some rather universal drivers of trust are: